Section 179: What Is It and How to Expense your Robots in 2023

December 7, 2023

Adding a robot to your medium-sized welding business can be a great solution to tackle the crippling welder shortage you are currently facing. In addition to automating your business, a welding cobot can boost production and lower scrap costs.

However, are you concerned about the price of a welding cobot? Wondering if it may be cost-prohibitive? The United States’ Section 179 Tax Deduction may be the answer!

What is Section 179 in the tax code? What equipment qualifies? Are welding cobots covered by Section 179? Let's find out.

What is Section 179?

Section 179, at its core, is a tax break offered by the US Government to small- and medium-sized businesses as an incentive to invest in modernizing their equipment. It allows them to deduct the total purchase price of qualifying equipment and software financed or purchased during the tax year. If you purchase or lease qualifying equipment, you can deduct the complete purchase price from your gross income when tax season comes.

However, there are limits to section 179. Below are a few essential details to remember.

- The cap for the total amount you can write off for 2023 is $1,160,000. This amount and clauses change each year, so be sure to check the IRS website, your accountant, or on the Section 179 website.

- The limit to the total amount of equipment purchased or leased is $2,890,000.

- The deduction begins to phase out on a dollar-to-dollar basis after $2,890,000 is spent by a business. This phasing out means the entire deduction goes away once you reach $4,050,000 in purchases.

- The 2023 bonus depreciation is at 80%. The amount for bonus depreciation changes every year.

Do Welding Cobots and Robots Qualify for Section 179?

Welding cobots and welding robots, along with their accessories, can qualify for the Section 179 deduction if the below requirements are met:

- The robot is leased or purchased. It can be a used robot (but new to you).

- Your welding business must use the cobot or robot in the year you take the deduction. For example, you must have purchased, integrated, and used your cobot or robot by the end of 2023.

- You have to buy it from a non-related, impartial party. This clause means you can't purchase the robot from your parents, grandparents, descendants, trusts, or charitable organizations with which you have a relationship.

- Your welding business cash flow must be positive and not at a loss to qualify for Section 179 cash savings.

How Much Can You Save from a Robot Purchase with Section 179?

Section 179 offers big savings for your equipment costs. If you want to know how much tax savings you can claim, use the Section 179 calculator, as it factors in all the limitations and changes to Section 179 for a given year.

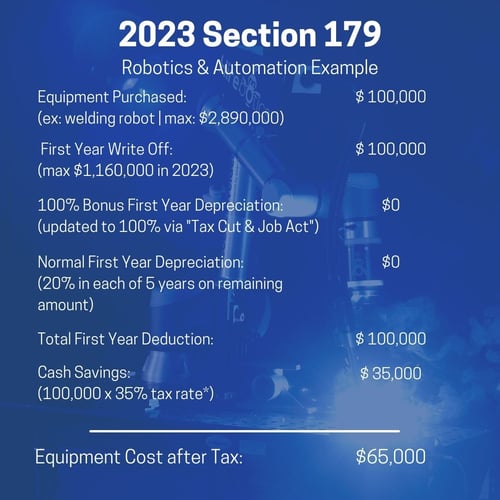

Here is a simulation Let’s say you bought a welding cobot that cost $100,000—assuming your company has a 35% tax bracket.

Your total first-year deduction is $100,000. That's $35,000 saved on a robot that you need!

You Still Have Time to take Advantage Section 179 For Your Robot

There are plenty of cobot welding solutions for you to choose from in the market. However, Cobot Welder from Hirebotics offers the simplest and most easy to use welding cobot on the market—no complex programming is required!

Interested in seeing a welding cobot with your parts before you buy? Schedule a demo with our team!